Custom Clearance

How do I get customs clearance for removals in the UK and USA?

After you find your ideal service provider, in this case, a customs agent, the process involves having to compile a number of required documents and a list of the inventory in question. If the agent is in the USA, UK, and the removal is to go to an EU country, then this is an export service, and vice versa.

What documents do I need for customs clearance?

The documentation would include elements such as the passport, insurance, the inventory list, proof of residence in the UK,USA and the EU country, the self certificate etc. This is if you are planning to move from the UK to the EU. Documents needed the other way round might differ slightly. There are many customs agents who provide this service.

Where do I need to go through the customs process?

Most countries in Europe are part of the European Union and there is no customs process when crossing the border. The few exceptions are: the United Kingdom, Switzerland and the Kingdom of Norway and USA. Moving goods to or from any of these countries requires a proper customs declaration and all the related documentation. Luckily the process is similar for each of the mentioned countries. To know more, please click the registration button above.

We recommend you apply for the TOR by sending all relevant documents to the HMRC at least 01 to 1.5 months before the collection. The approval process usually would take between two weeks to 1.5 months. This would depend on how busy they are. You can expect a smoother approach if you become prepared earlier on.

How do I get customs clearance for removals in the UK and USA?

After you find your ideal service provider, in this case, a customs agent, the process involves having to compile a number of required documents and a list of the inventory in question. If the agent is in the USA, UK, and the removal is to go to an EU country, then this is an export service, and vice versa.

WHAT IS CUSTOMS CLEARANCE?

Customs clearance is the process of declaring goods to Customs authorities when entering or leaving a country. Individuals or businesses can do this. Goods subject to customs clearance include items that are being imported or exported, as well as personal effects and commercial shipments.

When shipments arrive at a port of entry in the United States, they are subject to inspection by U.S. Customs and Border Protection (CBP). During this process, CBP officers inspect the documents associated with the shipment to ensure that all required information is present and accurate.

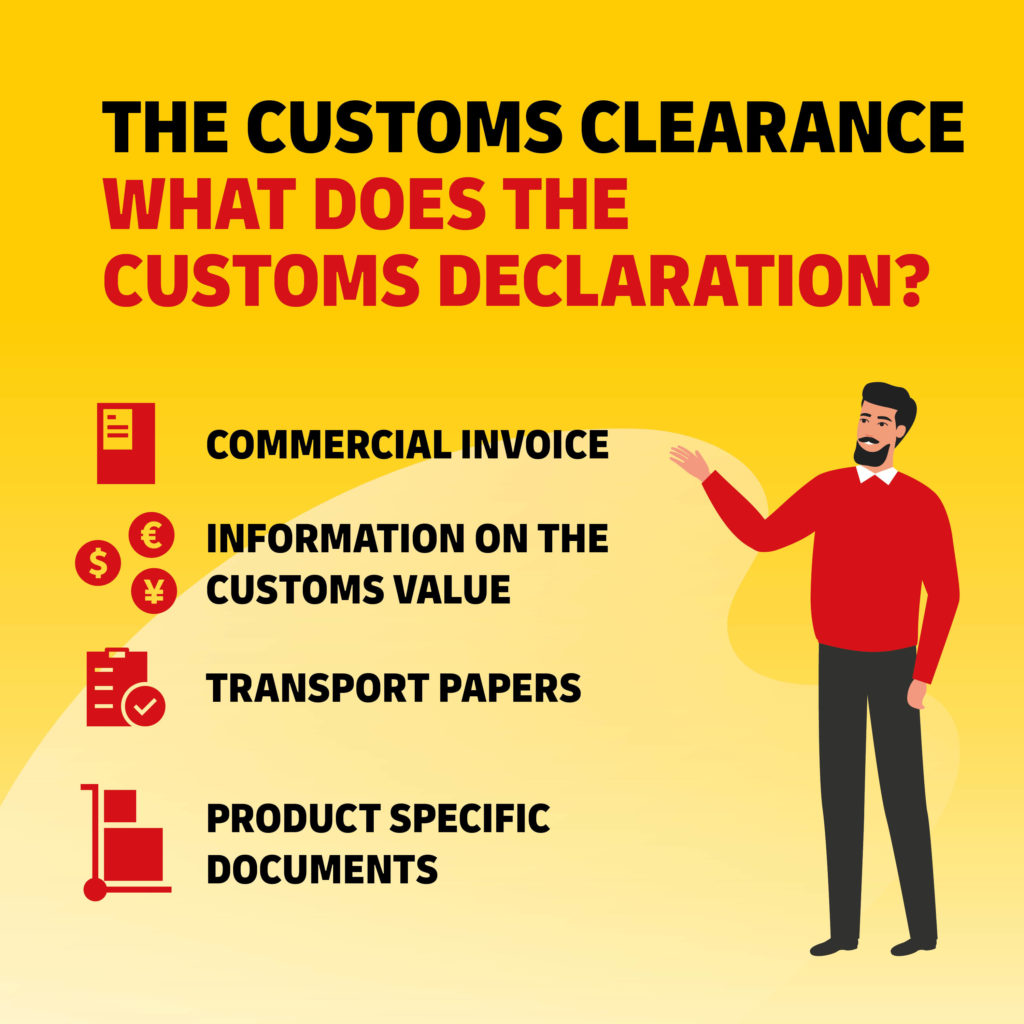

The most common documents required for clearance are:

- Proof of insurance

- Invoice (unless a commercial sample is worth less than $25)

- Port spending (when applicable)

- A packing list

- Certificate of origin (when applicable)

- Air waybill, inland bill of lading, through bill of lading, and ocean bill of lading

- Pre-shipment inspection certificate (when applicable)

- Transportation invoice

Once CBP has verified all the necessary documentation, they will clear the shipment for entry into the United States.

After your shipment has been inspected and all required import documentation has been filed, you’ll need to pay any taxes or duties owed on the goods before Customs will release them for delivery. The amount of tax and duty owed depends on several factors, including the type of goods you’re importing, their declared value, and the applicable customs laws.

For example, if you’re responsible for paying taxes and duties (i.e., if your shipment is delivered duty unpaid, or DDU), you need to arrange for payment with the customs authority in your country before they can deliver the goods.

On the other hand, if your shipment is delivered duty paid (DDP), the taxes and duties are included in the price of the goods, and you won’t need to make any additional payments. Either way, it’s essential to be aware of the potential costs involved in importing goods so that you can budget accordingly and avoid a late payment penalty.

After Customs inspects and assesses the goods, they are released from the warehouse where they have been held. The release process can vary depending on the type of imported goods but typically involves paying any customs duties or taxes owed. Once the release paperwork has been completed, the importer can take possession of the goods and move them to their final destination.

In some cases, goods may be released on a conditional basis, meaning that they must meet specific requirements before they can be moved off-site. For example, toxic chemicals may need to be appropriately labeled and packaged before they are released from customs. Ultimately, the customs clearance process aims to ensure that all imported goods meet all applicable regulations before they enter the domestic market.

When sending international shipments, be aware that they need to clear customs in each country your goods must pass through. This means that your goods will be subject to a customs clearance check in each country, and each country’s customs clearance process may have its requirements, standards, etc.

One of the best ways to ensure successful customs clearance is to expect multiple checks. This way, you can be prepared with all the required documents and information for each country and know exactly what to expect at each process step. It’s also a good idea to research the customs clearance requirements of each country in advance so that you can be sure your goods meet all the necessary standards.

For anyone importing goods into the United States, be aware of the potential customs clearance fees that may be owed. These fees are based on the value of the imported goods and the specific tax rates that apply to those goods under the Harmonized Tariff Schedule. In most cases, importers are also required to purchase a bond as surety that all taxes and duties will be paid.

To calculate the overall cost of customs clearance, importers should first determine the value of their goods. They can do this by adding up the cost of all individual items and any shipping or insurance charges. Once they know the total value, importers can look up the specific tax rates that apply to their goods under the Harmonized Tariff Schedule.

These rates vary depending on the type of goods being imported, so it is important to consult the Harmonized Tariff Schedule beforehand. Finally, importers should multiply the total value of their goods by the appropriate tax rate to calculate the taxes and duties they will owe.

While navigating the customs clearance process can be tricky, taking the time to calculate taxes and duties upfront can help ensure a smooth and successful importation. In addition, by knowing how much is owed in fees, importers can avoid any unexpected charges or delays at the border.